FTSE 100 FINISH LINE 7/1/26

FTSE 100 FINISH LINE 7/1/26

The FTSE 100 index hit the brakes on Wednesday, retreating 0.7% after an impressive streak of record highs. Investor sentiment turned cautious amid developments between the U.S. and Venezuela, prompting a shift toward defensive sectors like utilities and real estate. Adding to the mixed economic picture, the UK Deloitte CFO survey for Q4 2025 revealed improved optimism, with the net balance rising to -13 from -24 in Q3, potentially driven by post-Budget relief during December fieldwork. However, its limited sample size of 55 large corporates contrasts sharply with the Federation of Small Businesses (FSB) index, which has consistently reported weaker confidence among SMEs since Q2 2024. Challenges such as minimum wage increases and complicated business rate changes may hinder similar optimism in the SME sector for Q4. This disparity underscores the UK's "K-shaped" economy, where large businesses and smaller enterprises experience contrasting fortunes.

Energy stocks bore the brunt of Wednesday’s decline, tumbling 2.5% as oil prices dropped following U.S. President Donald Trump’s agreement to import up to $2 billion worth of crude oil from Venezuela. Major players like BP and Shell saw notable losses, slipping 2.9% and 2.2%, respectively. Precious metal miners tracked by the FTSE 350 index also faced pressure, falling 2.4% as gold prices declined by over 1%. This pullback comes after UK equities started the year on a high note, with the FTSE 100 surpassing the 10,000-point mark for the first time last week. Investor enthusiasm had been fuelled by expectations of potential Bank of England interest rate cuts later this year. Tuesday alone marked the fourth record high for the index within just five trading sessions. Meanwhile, the FTSE small-cap index narrowly missed its all-time high from 2021, dipping 0.5% earlier in the day.

On the corporate front, Topps Tiles saw its shares rise 1.5% after reporting a 3.7% growth in first-quarter revenue, driven by robust demand from builders and contractors. Edinburgh Worldwide Investment Trust also gained traction, climbing 1.8% after its largest shareholder, Saba Capital, urged investors to back a new independent board. The move follows concerns over a "suspiciously timed" sell-off of the trust’s SpaceX holdings.

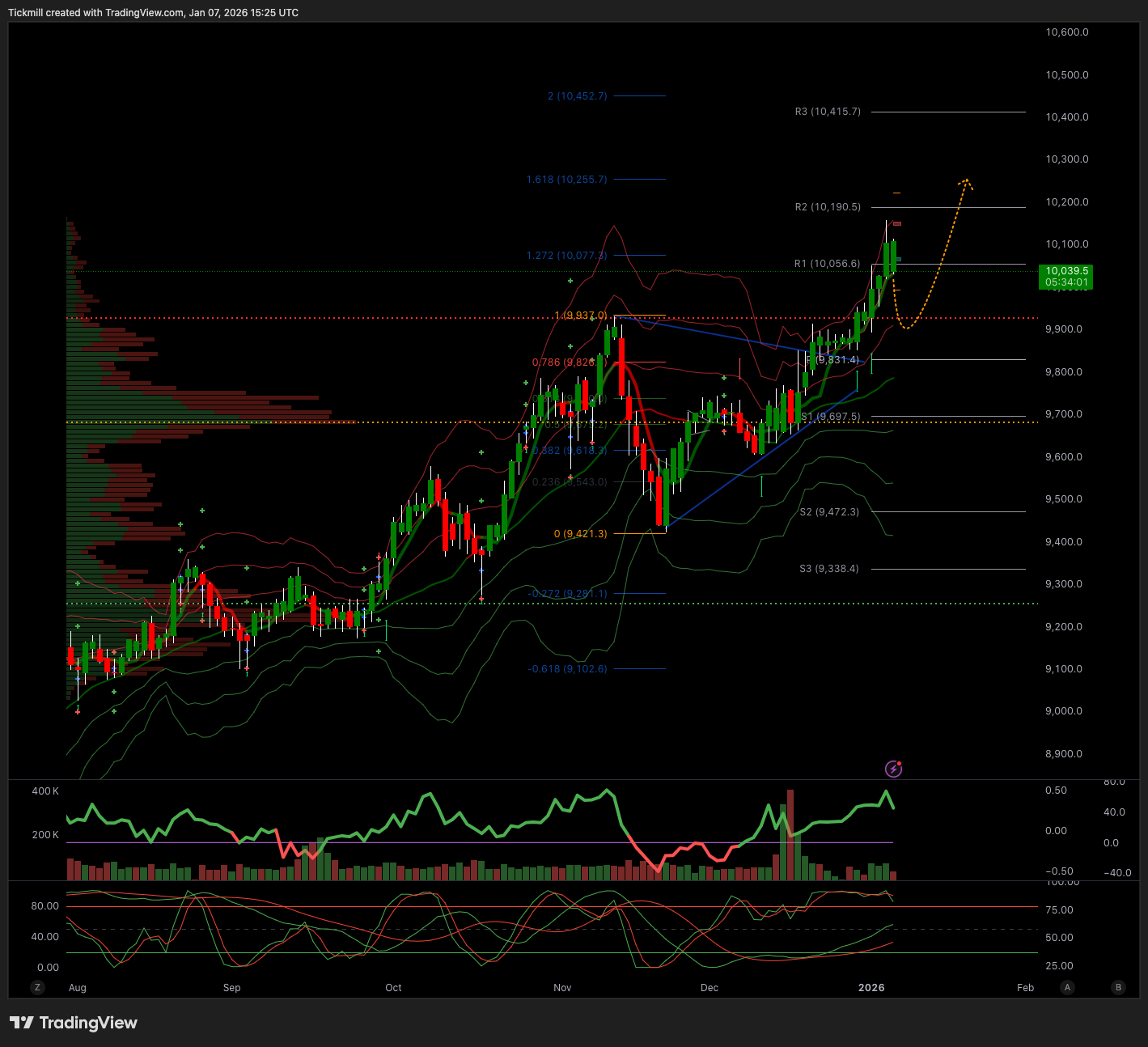

TECHNICAL & TRADE VIEW - FTSE100

Daily VWAP Bullish

Weekly VWAP Bullish

Above 10050 Target 10250

Below 9930 Target 9800

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!