THE FTSE FINISH LINE 23/10/25

THE FTSE FINISH LINE 23/10/25

The FTSE 100, London's leading stock index, soared to a record high during intraday trading on Thursday, buoyed by a surge in oil stocks and strong performances from major companies like the London Stock Exchange Group (LSEG) and Rentokil. The FTSE 100, known for its heavy weighting in commodities, climbed as much as 0.7%, reaching an all-time high of 9,579.07 points, and was still up 0.7%. Oil giants Shell and BP saw their shares rise around 3% each, driven by a more than 5% spike in crude oil prices. The rally came after the U.S. announced sanctions on key Russian energy suppliers Rosneft and Lukoil in response to the ongoing conflict in Ukraine. Among individual stocks, LSEG surged 6.7% after revealing plans to sell a 20% stake in its post-trade services business. The exchange operator also surprised investors with a £1 billion ($1.34 billion) share buyback program and posted third-quarter results that exceeded expectations. Meanwhile, Rentokil stole the spotlight with an impressive 11.8% jump in its stock price. The pest control company reported stronger-than-anticipated growth in quarterly organic revenue, further boosting investor confidence.

The UK equity market has been bolstered this week by a combination of upbeat corporate earnings, a rally in commodity stocks, and signs of cooling inflation, which have fuelled hopes for a potential interest rate cut by the Bank of England. The FTSE 100 is on track to achieve its best weekly performance since April.

Elsewhere, the FTSE 250 index, which focuses on more domestically orientated companies, edged up 0.1%, reaching its highest level in nearly four years. Precious metal miners also enjoyed a strong session, with their index climbing 4.5% alongside rising gold prices. Heightened geopolitical tensions—sparked by U.S. sanctions on Russia and the possibility of new export restrictions targeting China—drove investors toward safe-haven assets like gold. Not all sectors fared well, however. InterContinental Hotels Group, the owner of Holiday Inn, saw its shares slip 1.2%. Despite reporting growth in a key revenue metric, the company's performance was dampened by slowing momentum in U.S. markets. Overall, it has been a remarkable week for UK stocks, with optimism running high amid robust earnings and favourable market conditions.

Shares of Renishaw, an engineering company, declined almost 5% to 3,540p. The stock was one of the biggest losers on the FTSE 250 index, which saw a slight increase of 0.23%. In the first quarter of FY26, revenue fell to £170.8 million ($229.23 million), down from £173.9 million the previous year. "Regionally, EMEA was the weak link, with OCC revenue dropping by 20.5% due to weak demand for industrial metrology products and a negative effect from ERP implementation, which is anticipated to be recovered in the second quarter," noted Jefferies. Year-to-date, factoring in the recent movement, the stock is up nearly 10%, compared to the sub-index's almost 8% increase.

Shares of St James's Place fell by 4% to 1,299p, making it the worst performer on the FTSE 100. The British fund manager indicated that Q4 flows might be weaker than in Q3 due to an uncertain consumer landscape and lack of clarity regarding the autumn government budget. Jefferies noted, "We anticipate that consensus will rise slightly on improved flows and investment performance, but the upcoming budget could introduce caution in share price movements." In Q3, net inflows totaled 1.76 billion pounds ($2.36 billion), compared to 890 million pounds from the previous year. Year-to-date, SJP has increased by approximately 49.71%.

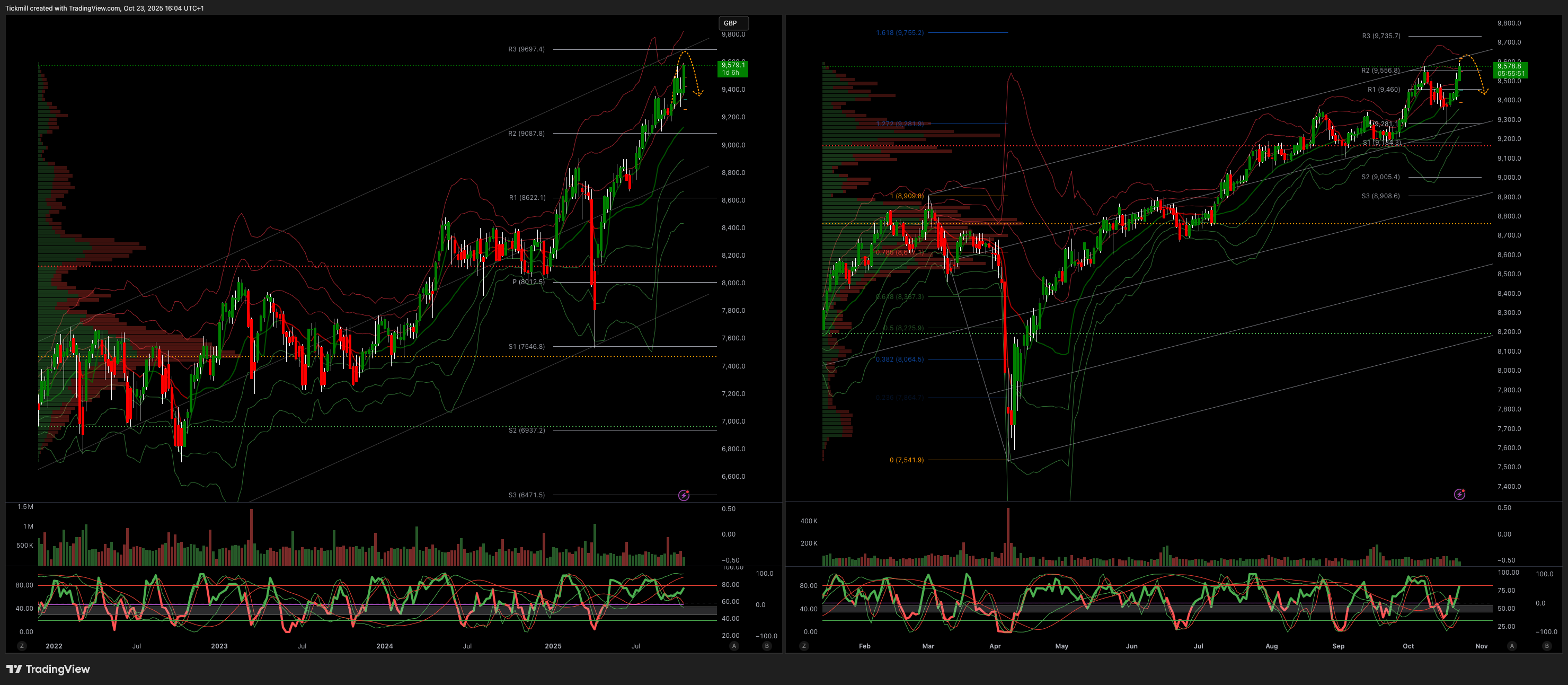

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9330

Primary support 9000

Below 9300 opens 9000

Primary objective 9600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!